You will receive a call within 24 business hours (8 AM to 9 PM, except Sundays)

- Home

- Investor Corner

- Mutual Fund

Get started on growing wealth

All you need is an Android or iOS smart phone device with internet access to download, install and start investing!

Download The Canara Robeco Investor App

Download the Canara Robeco Investor App in just a few clicks via the Google Play Store or App Store.

Ready To Use In An Instant

No Sign-up Required For Already Registered Users of Investor Portal.

Steps to use the Mobile app

Easy To Download

Go to Google Playstore or App Store Click on download to install the app on your smartphone

One-View Dashboard

Take an account of all your investment activities in one go

Any Time Access

Perform investment activities whenever you wish.

Transacting Capabilities

Purchase, redeem, switch or invest systematically!

MF Investments

Check NAVs, track SIPs, or download all investment statements in one place!

Quick Payment Options

Pay swiftly through internet or mobile banking!

Frequently Asked Questions

What is Canara Robeco Mutual Fund Investor App? What are its Benefits?

The Canara Robeco Mutual Fund Investor App is a convenient and quick way to access the Investor Services offered by Canara Robeco Mutual Fund. It is an Easy to Use One Stop Shop for all the Existing Investor Services.

It has various benefits such as:

- It offers Transacting capabilities on the go from your smartphone itself

- Non-KYC customer can submit KYC form

- You can Invest, Track, and Manage all types of Canara Robeco Mutual Fund Investments through the App itself

- It offers safety features such as login through Biometric, PIN, OTP, etc

- It contains Quick Payment as Net-Banking for your convenience

What are some Limitations of the App?

- Only a Resident Individual Investor can use Mobile App Services

- The App does not allow users such as HUF, Joint holder, DEMAT users and NRI/NRE Investors to transact

Where to Download the Application from?

Anyone with an Android or iOS smartphone/Tab has the app available for them to download. Only internet access is required to download and install the application for free from the Google Play Store or the Apple App Store respectively. Post installation App icon will be visible on your smartphone and it will be ready to use.

What are the Features Available to users of the App?

After Login, the Main Services Offered by the App are:

- Portfolio Dashboard

- Detailed Portfolio

- Transact in My Folios

- Transaction History

- IDCW

- NAV

- SIP Calendar

- Pause/Cancel Systematic Transaction

- Download Account Statement

Few Services are also available for all investors of CRMF without Logging into the App. They are:

- Consolidated Account Statement,

- Know Your Transaction,

- Capital Gain/Loss Statement, and

- Capital Gains Statement through Folio

How to use the App?

Upon clicking on the app icon, you will see the login page.

- If you are a New User

- If you are an already Registered User

New users needs to complete registration first.

Click on the “sign up now” link and provide your KYC Compliant PAN in the given field to start. After providing other required information, you need to enter the Email ID to be registered for your mutual fund investments and make a Password. Then click on submit to complete registration on the app.

If you are an investor who is already registered on the Canara Robeco SmartInvest / app, you can either use your Username/PAN and Password created during Sign Up to Login or with one of the other modes of login such as a Pattern, Biometric, or a PIN setup by you.

What if my PAN is not KYC Compliant? How can I complete KYC in such a case? Can my KYC be done through the app itself?

During Sign Up, the app verifies whether Pan is KYC Compliant or Not.

If the Pan is not KYC Compliant, then the app will redirect the user to eKYC Karvy KRA.

Here the user will have to enter a Username, their contact details and other required information and follow steps as per the instructions given.

An e-Aadhaar based EKYC will be done which requires a new investor to download masked e-Aadhaar from UIDAI website before starting the EKYC process.

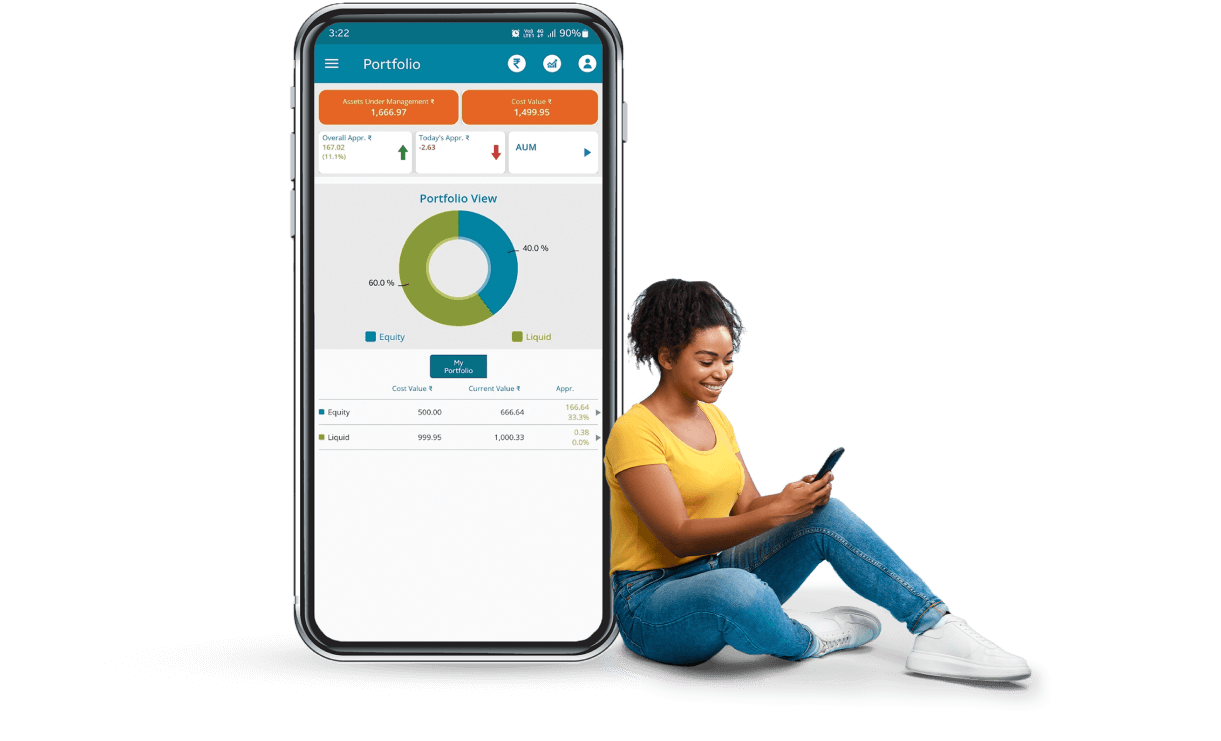

What is the Portfolio Dashboard feature on the App?

Upon Login, the app opens the Portfolio Dashboard page.

Here you can view your investments portfolio and its allocation to various asset classes such as Equity, Debt, Hybrid.

If you want to know in detail about investments in a specific asset class, you can just click on a specific asset class shown on the dashboard, and you will be redirected to its scheme and folio level details page.

How to view Detailed Portfolio of a Specific asset class in the Mobile App? Can a transaction be incurred from the Detailed Portfolio itself?

You can view detailed portfolio for yourself and of your family by clicking on a specific asset class on the Portfolio Dashboard. Your Scheme level holding Details with latest NAV and Folio level details for the scheme will be displayed to you on the screen.

You can also transact at your folio level (Additional Purchase, Redeem, and Switch) through the quick links provided at the bottom of the Detailed Portfolio page.

How to do various MF transactions from the App? Which transactions can be done through the Transact in My Folios Feature of the App?

You can do various transactions through the Transact in My Folios module, such as:

- Investment in NFO’s,

- New Purchases in new and existing mutual fund schemes,

- Additional Purchases in new and existing mutual fund schemes,

- Redemption,

- Switch,

- SIP,

- SWP, and

- STP

How to view the Transaction History via the Mobile App?

Upon selecting the Transaction History Tab in the Menu, your last 10 transactions are listed . You can click on the track button for any transaction history item to display that transaction’s status details.

How to view the NAV of any MF scheme in the App? Can Historical NAV during a specific Time Period be viewed through the App?

You can use this feature to view the latest NAV and historical NAV at the scheme level. You have to select the asset class and scheme whose NAV you wish to view. You can change the time period for the NAV which is to be displayed.

Is there a feature on the App which displays dates of current ongoing SIPs’? Can reminders be set for specific ongoing SIPs’ via the SIP Calendar?

This feature displays the dates of your various ongoing SIPs’. You can check the SIP dates for the upcoming months by changing the month selection. You can also set a reminder for a particular SIP.

How to Pause/Cancel Systematic Transaction from the Mobile App?

You can pause or cancel various systematic transactions like SIP, SWP, and STP using the Pause/Cancel Systematic Transaction feature module. You need to first select the schemes for which systematic transactions have to be paused or cancelled. You will receive an OTP to confirm the transaction and on successful verification of the OTP, the systematic transaction will be paused or cancelled.

Can the Account Statement be viewed or downloaded from the Mobile App?

Using the Account Statement feature, you can download and view your folio based account statements by selecting specific folios and schemes.

Which are the Services Available without Login on the Mobile App?

Four services are available to all investors of CRMF irrespective of their login status on the app. You do not have to login to the app to avail these services. These are – Consolidated Account Statement, Know Your Transaction, Capital Gain/Loss Statement, and Capital Gains Folio.

What is Consolidated Account Statement Feature? How to use it?

You can use this feature to generate an account statement for your investments across CRMF and other funds as well which are serviced by the RTAs KFintech and CAMS which have the same Email ID registered to the funds.

You need to input a Password to protect the statement.

On submitting, after input of Email ID and Password, the account statement is generated and sent to your registered email ID with password protection.

What is usage of the Know Your Transaction feature available on the App? What information is required to use the feature?

This option helps you to know the status of any of your fund transactions up to the last 20 days. You just have to select the Transaction type, Folio/Application No, and your PAN and the information will be generated on pressing submit.

How to get Capital Gain/Loss Statement through the Mobile App? What are the details and steps required to receive the Capital Gain/Loss Statement via Email?

Using this feature, you can opt to receive an Email of the Capital gains/Loss statement based on your PAN.

Here also, you have to create a Password for the document and select a date range based on which the Capital Gains/Loss Statement will be generated.

You can choose to have a PDF or Excel File to be Emailed to you which will be protected by the password you created on this page.

Can we get Capital Gains statement only for a specific Folio? What information is required to receive Capital Gains Folio via Email?

You can opt to receive capital gains statement based on a specific folio via Email through the Capital Gains Folio feature.

You need to select folio and create password for the statement to be shared via Email. You also have to select a date range based on which the Capital Gains statement would be generated.

Upon clicking submit, the Capital Gains Statement protected by the password created by you, would be sent to your registered Email ID.

Which User details are present in My Profile on the App? Can Details be modified from the My Profile?

You can save your details in My Profile for initiating New Purchase transactions quickly.

When processing a New Purchase request all the details input in Demographic, FATCA, and Communication Details tab will be automatically used. You will have the option of selecting the nominees and banks available in My Profile at the time of New Purchase.

You can view the various Folio Details in the Folio Details tab present in the My Profile.

What are the Security features accessible from the Settings tab on the App?

You can use the Settings tab to setup, enable, or disable Biometric modes of Login (Fingerprint, face Recognition, etc.) on supported devices as well as PIN and Pattern options for Easy Login into the app.

You can also change your password as well as enable or disable your Login OTP as a user.

Will we receive SMS and Email Notifications of transactions carried out through the Mobile App? When are SMS and Email Notifications sent?

You will receive SMS and Email Notifications of the transaction status on receipt of fund transactions. You will also receive SMS and Email post the transaction being processed to view the units allotted to you as well as the transaction amount.

I just made my investment today. When will I receive my Account Statement?

You will receive the Statement of Account within 3-4 working days from the date of transaction of investment with the selected Mutual Fund Scheme carried out on the app.

Can my Redemption Proceeds be directly credited to my Bank Account?

Based on your Redemption request, the Redemption Proceeds will directly be credited to your Bank Account if you already have a designated direct credit Bank Account for the mutual fund.

What should I do if I am unable to Login with existing User ID and Password?

Sometimes an Incorrect User ID or Password is entered. In Such Cases, you do have the option to reset your Password using the “Forget Password” Option.

If you are still experiencing trouble logging in, you can reach out to appsupport@canararobeco.com .

In case the query is not resolved, you may also raise a complaint at crmf@canararobeco.com or at IRO@canararobeco.com .

What to do if My Transaction Failed, yet My Bank Account has been Debited?

If the transaction has failed and the amount is debited, then it would take 3 working days to refund the debited amount to your bank account. You can reach out to the support team if you have any further concerns.

I have 3 folios but only 2 are visible?

There could be a new folio in the process of creation and allocation. It would take T+1 days’ time to create and allocate the folio. If you still do not find the folio you can reach out to our support team for assistance.

I am unable to redeem my units in the App?

It may also be possible that the value of units you are redeeming are less than the minimum amount which may be redeemed. Hence you are unable to redeem it.

In such cases, please modify the units to match with the amount specified as Minimum Amount while redeeming the units from the app.

I am not getting an OTP?

It would take approximately 30 seconds to receive an OTP from the time of transaction. You can also try the option of re-sending the OTP which is available to you.

If the OTP is not received using the attempt to resend the OTP, you can reach out to appsupport@canararobeco.com .In case the query is not resolved, you may also raise a complaint at crmf@canararobeco.com or at IRO@canararobeco.com.

How to Raise a Complaint in case of any Other Issue?

You can raise a complaint through email with CRMF AMC directly through the app. You will shortly receive an automated email response with a unique service ticket number which will be used by the Investor Relations Team personnel to follow-up with the user for resolution of the issue.