Dont wan't to watch the video, read the text instead.

The moment we hear the word Mutual Funds, the most heard classic disclaimer “Mutual Fund investments are subject to market risks” rings the bell in our mind. It is very important that we understand what risk is and how it is measured. Experts define risk as a possibility of investment’s actual returns being lesser than the expected returns.

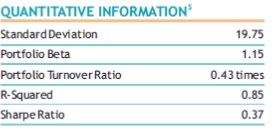

Every fund discloses risk involved in it in the monthly factsheet published by the fund houses. We broadly use Standard Deviation and Portfolio Beta to measure the risk involved in mutual funds.

What is Standard Deviation – (SD)?

Standard Deviation measures the total/portfolio risk of the fund. The deviation from the average (mean) returns of the fund is called standard deviation. SD tells us the range in which the returns of a mutual fund would fall. Range represents the difference between the lowest returns and the highest returns of the fund.

| Fund A | Fund B | |

|---|---|---|

| Average returns | 14 | 14 |

| Standard Deviation | 24 | 12 |

| Range | .-10 to 38 | 2 to 26 |

| (Data given are in % terms) | ||

Higher the range in returns indicates higher risk, which is nothing but higher standard deviation. Risk is a relative term; conclusions can be arrived only by comparing multiple funds.

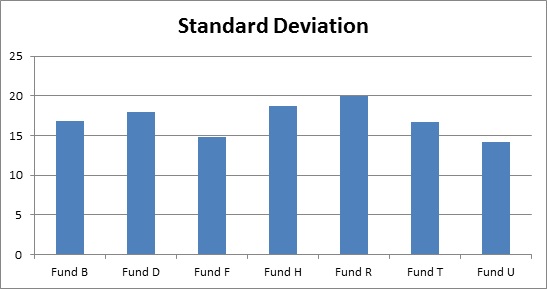

The above said illustration compares the standard deviation of 7 diversified equity funds. When compared fund R carries the highest SD (20) in the category can be called as riskiest fund and Fund U rates below average in risk grade.

What is Beta?

Beta measures market risk or systemic risk. In other words, Beta measures the sensitivity of the fund to the changes in the market (Sensex/Nifty). Market beta is assumed as 1 and the fund beta is compared against the market beta. If the fund beta is less than one, then we can conclude that the fund is less volatile in comparison to market and vice-e-versa.

If the fund beta is 0.7 and the market goes down by 1%, then the fund would go down by 0.7% and if the market goes up by 1% the fund would go up by 0.7%. If beta of the fund is 1.2 and the market goes up by 10% then the fund would go up by 12%.

| Fund | Beta |

|---|---|

| Fund B | 1.09 |

| Fund D | 1.18 |

| Fund F | 0.99 |

| Fund H | 1.23 |

| Fund R | 1.31 |

| Fund T | 1.12 |

| Fund U | 0.97 |

Fund R with 1.31 beta is considered as the most volatile fund in the category. In case of Fund U and Fund F, even though the beta of the funds is less than 1, it is still very close to 1 so the risk associated would be closest to the market.

When Beta is compared with Standard Deviation, Beta measures market risk but the Standard Deviation measures total risk (both systematic and un-systematic).

Note: The above table is for illustration purpose only & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund. Past performance may or may not be sustained in the future.