Dont wan't to watch the video, read the text instead.

The dictionary meaning of wealth is abundance. When spoken in the context of money, it would obviously mean an abundance of money. Well, this may seem a strange explanation because money is a limited resource for all of us after all. In fact, since most of us face the issue of having limited wealth, we need to prioritize our needs in order to ensure that we use this resource in the most optimal manner to fulfill the most important needs or goals.

Typically, all the money that is surplus to you at the present moment could make up your wealth. It may of course be needed in future to meet your financial commitment. Your wealth could be in the form of property, deposits, gold, shares and other such assets.

The important determinants of wealth

The amount of gross wealth that you can potentially build up in your lifetime (ignoring the utilization on financial goals for the sake of simplicity) typically depends on three main factors namely:

- Amount of savings

- Return that your savings earn and finally

- The length of time that you allow your savings to grow.

Here is a detailed look on how each of these factors affect your wealth.

Importance of saving and investing towards wealth creation: It takes money to make money; just as it takes wheat to grow wheat. A healthy savings rate is the basis for creating wealth. This could of course raise the question as to what a healthy savings rate actually is. Well, it simply is the rate that enables you to achieve your financial goals, given your investment temperament and preferences. Remember, it is your savings and not gross income that makes you wealthy.

Importance of returns in wealth creation: It is quite obvious that higher the return that your investment earns more is the wealth that you are going to create for yourself. But how high a return is good enough? Well, this again is a question that your financial plan alone can answer. Your investments have to earn a return which is enough to meet your financial commitments. But at a very basic level, your post tax investment return should at least match the inflation levels just to stay afloat. If the return falls below the prevailing inflation level, your wealth would be eroded or destroyed. The purchasing power of your wealth weakens gradually over time if it underperforms the inflation level. So, inflation would be the floor level that your wealth would have to earn post-tax over time, just to stay where it is in terms of relative value.

And what is the highest level of return that you can or should aspire for? This will in practice be determined by two factors:

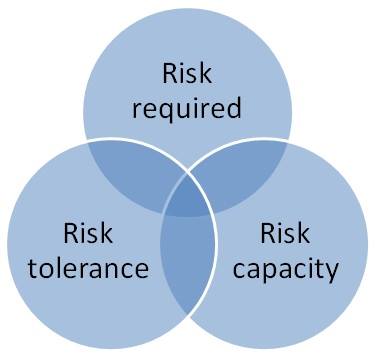

Your risk profile

What is the level of risk that your financial position forces you to take? If the gap between your present and future is large, you may need to take on quite a bit of risk with your investments in the hope that the potentially higher returns would help you bridge the gap. But even if this gap is large, what if your financial situation is such that you cannot afford to take risk? For example, you may have a large amount of loan to repay or your primary, earned income itself is too unstable or uncertain. In this case you may not be able to expose your investments to a high degree of risk. And finally, are you comfortable with the gyrations of the equity market? If your investments are going to keep you awake all night, your wealth would mean little to you.

Financial prudence.

Your risk profile is only one part of your investment puzzle. The other part is about financial prudence. Even if you have the requisite risk profile, is it wise to put all your money in one risky asset? What if the asset underperforms for an extended period of time? What if you need some money at short notice? It is always prudent to spread your investment among multiple asset classes because: Different asset classes perform differently across time periods.

Your portfolio downside would be limited as chance of all assets declining simultaneously is remote. Return should always be measured through the prism of risk taken.

A prudent asset allocation pattern that takes care of your risk profile and return requirements could be the secret of your success. You need to allocate your investments among the various assets according to this pattern and more importantly rebalance back to the original allocation periodically. As different assets perform differently during any given time period, your allocation is likely to get skewed towards the strong performer which increases the risk of your portfolio.

Finally, building wealth takes time.

Just as it takes years or even decades for a seed to grow into a tree, your wealth too needs to be given sufficient time to grow. With adequate time, the magical power of compounding ensures that your wealth is multiplied multifold. As the graph below depicts, this growth is not uniform over the time period but is more back loaded. That is maximum growth happens towards the latter half of the investment period.

The above is for illustration purpose only & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund.

You would notice that nearly two-thirds of the growth in the investment value is in the last ten years of the thirty year investment. It therefore becomes crucial that you start your investment at the earliest and allow compounding to magnify your results over time.

In a nutshell:

High earnings alone cannot make one wealthy. It is the discipline and financial prudence in utilizing those earnings which are the true determinants of wealth.