Dont wan't to watch the video, read the text instead.

Introduction

Mutual funds are usually perceived as volatile investments by most investors and have most recently become a popular avenue of investment. However, contrary to the perception of many, mutual funds do not only invest in equity markets, or in other words, there are other than equity oriented mutual funds too. Debt mutual funds have a substantial share in the Indian mutual fund landscape and therefore, it is important for investors to understand the significant features of these schemes.

A debt mutual fund is a mutual fund scheme that invests in fixed income instruments, such as bonds issued by the government and corporates, debt securities, and money market instruments, etc. The fundamental reason for investing in debt funds is to earn a steady interest income and capital appreciation. The issuers of debt instruments pre-decide the interest rate you will receive along with deciding the maturity period. Hence, they are also known as ‘fixed-income’ securities. They have lower volatility and, hence, are less risky than equity funds. However, this also means that debt investments offer lower returns as compared to equity investments.

We will be discussing how safety, liquidity and returns are differently managed in various types of debt funds.

Safety in Debt Funds

Safety in Debt Funds

As has been mentioned above, debt mutual funds are less volatile than equity counterparts. Debt mutual funds invest in debt securities, where interest income is regular, and prices are relatively stable. This makes these funds safer than equity mutual funds. Debt funds also have inherent risks involved, not limiting to Credit / Default risk, Interest rate risk and Liquidity risk. These risks can be mitigated by choosing an appropriate debt fund after studying the characteristics of the said fund.

-

■ Credit Risk - For e.g., If an investor wants to avoid credit default risk, he/she should choose funds which have higher credit ratings and superior quality papers in the portfolio. Credit risk is measured by “Credit ratings”. Credit rating agencies like CRISIL, ICRA, CARE etc. rate the issuer of the bond on their ability to repay by assessing their overall financial health. Besides, investing in gilt funds also helps in avoiding credit default risks as these funds invest in government securities and they possess the lowest credit default risk.

-

■ Interest Rate Risk - Market price of the bond and interest rates carry opposite relationship. Whenever interest rates in the market go up, the market prices of bond come down. Therefore, in order to avoid or minimise interest rate risk, investors should choose debt funds with lower maturity as usually, longer the maturity, greater the degree of price volatility. Interest rate risk is present in all debt funds, but the degree could vary. For e.g., a low duration fund has lower interest rate risk than a short duration fund or a medium duration fund.

-

■ Liquidity Risk - It can be avoided by choosing funds from the overnight, liquid and liquid plus categories which include ultra-short duration, low duration and money market funds. These funds have lower maturities and more liquid papers in their portfolios than longer duration funds. Also, funds with higher credit ratings tend to be more liquid as high rated papers are more in demand in the capital markets.

Liquidity in Debt Funds

Liquidity in Debt Funds

Debt Funds are more liquid as compared to other available traditional savings options as investors can invest and withdrawal, fully or partially, at any time. However, some of them could have an exit load just like fixed deposits. In order to avoid exit loads, investors can choose funds accordingly which do not have exit loads.

Investors seeking liquidity can choose funds from the liquid and ultra-short-term categories which are most suitable for short term parking of funds as they require more liquidity. A Liquid Mutual Fund is a debt fund which invests in money market instruments like commercial paper, certificate of deposit, treasury bills, etc. with a maturity of up to 91 days. The net asset value (NAV) of a liquid fund is calculated for 365 days. Further, investors can get their withdrawals processed within 24 hours). An ultra-short-term fund also invests in similar money market instruments with a maturity between 3 months and 6 months. These funds have no entry and exit loads in most cases and offer the highest degree of liquidity thus acting as an excellent avenue to park one’s surplus cash for short periods of time.

Returns in Debt Funds

Returns in Debt Funds

The returns in debt funds come from two sources–the interest rate component and the gain (or loss) on the value of the instrument. The interest income is known at the time of making the investment and are received periodically or on maturity along with the principal. The coupon on a debt instrument depends on its tenor and credit quality. Bonds with longer tenors, typically, have higher coupons. Similarly, bonds with lower credit ratings, which imply higher default risk, have to offer a higher coupon rate to attract investors.

The second component of returns is from an increase in the value of the securities held. This gain in value will add to the coupon income and push up the net asset value (NAV) and returns of the scheme. The gains or loss in the value of the securities is driven by changes in interest rates in the market. When interest rates are on the decline, debt mutual funds appreciate in value as these funds endeavour to benefit from the inverse relationship between prices of debt instruments and interest rates.

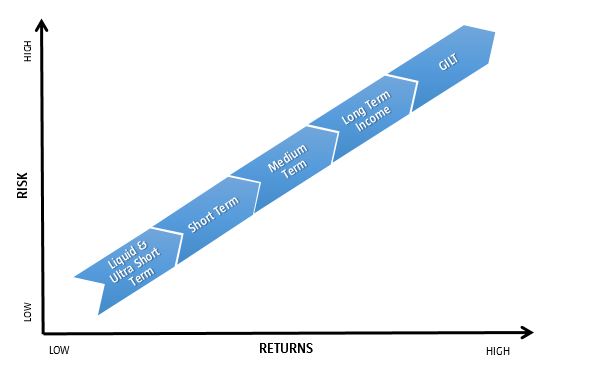

The above matrix shows that relationship between risk and returns among debt funds as per the categories. It means that the lower the maturities of the funds, the lesser risk they possess and thus give lesser returns as compared to funds with longer maturities. Funds that target higher total return invest in longer-term debt securities to gain more from any appreciation in value, along with the regular coupon income. The returns from such funds are likely to be volatile since the NAV may move up and down with changes in the value of the securities. They are better suited for long-term investing. Investors should be aware of their risk appetite and financial goals before choosing a fund based on its returns. They should also evaluate the maturity profile of the fund, credit risk (which can be seen by previous credit rating allocation of the fund) and other quantitative data of the fund.