Dont wan't to watch the video, read the text instead.

Congratulations on your newly acquired “bundle of joy” and welcome to parenthood. Or perhaps you already are a parent but the arrival of the new one has got you thinking about their future, their education. Giving your child a good education can be one of the most valuable gifts you can ever provide but it can also be one of the most expensive. Plan for the future to avoid scrambling around at the last minute to find ways to pay for your loved ones' education, or worse, compromising on the quality of education just because you cannot afford it.

Let’s look at the cost of an M.B.A. course in India from a relatively good university. This currently costs at least Rs. 5 lacs per year. That’s 10 lacs for the course and this price will only increase over time. If you hope to send your child or children abroad to study, the expense will be much greater. For example, an undergraduate university in the U.S.A. can cost from USD 30,000 (INR 18 lacs) upwards per annum and most of them are 4 year courses. Ouch!

Let’s look at some projected expenses within India:

| Cost of Higher Education | 2013 | 2033 |

|---|---|---|

| Engineering | Rs. 3-5 lakhs | Rs. 11.2 lakhs |

| Medical | Rs. 7-8 lakhs | Rs. 22-26 lakhs |

| MBA | Rs. 10 lakhs | Rs. 32 lakhs |

Source: Engineering and MBBS fees are calculated as average fees of top colleges according to TOI, 11 January 2013. MBA fees are calculated as average fees of top colleges according to Business Standard, 5 February 2013. The inflation rate has been taken as 6% per annum.

Clearly, for most of us, these are big chunks of money and seem like intimidating financial goals to achieve. Undoubtedly, your salary will increase over the years, but so will your expenses. Your money should work as hard as you do to help you reach your financial goals. Now coming back to funding your child’s education..

The 2 main avenues for investing are debt and equity. Debt is generally considered to be a safe investment. The flip side is that the returns tend to be limited, unlike equity investments, which have historically provided superior returns when people remain invested over an extended period of time i.e. over years as opposed to months.

History has shown that for patient, long term investors, equity is the preferred option since it is likely to provide much better returns than debt. Within the equity category, unless you are an expert investor and knowledgeable about the potential vagaries of the stock market, your best bet is investing via equity mutual funds since these are managed by professionals.

3 parameters you should look at when deciding where to park your savings are:

1) Investment horizon – how long can the money remain invested without needing to withdraw all or even part of it? The longer your investment horizon, i.e. more than 3 or even 5 years, the better it might be, since such extended periods often enable you to withstand the risks, of investing in equities. For horizons less than 3 years, an investment in debt should be considered as this is generally less risky than equities.

2) The impact of inflation – investments in debt such as, fixed deposits or other bonds, often provide minimal (low, single digit) returns when we take into account inflation. For example, if inflation is at 7% and you are earning 10% in a fixed deposit, you are effectively only earning a 3% return.

3) The power of compounding. If you are able to plan years in advance and can put aside funds on a regular basis (see SIP), you will benefit greatly from compounding.

For example, if you expect that one child’s college fees to cost you Rs. 20 lacs, here’s what you need to do to ensure you have that liquidity when required:

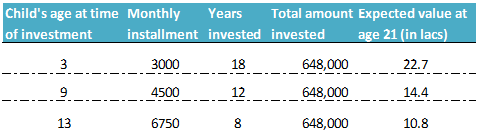

If you start investing when your child is 3 years old, you only need to invest around Rs. 3,000 per month, to reach (and in this instance, actually exceed) your targeted amount. If you start when your child is 13, and you more than double your monthly installment (from Rs. 3,000 to Rs. 6,750) the amount you will have totally invested will be the same (almost Rs. 6.5 lacs in both cases).

However the expected value at age 21 is only Rs. 10.8 lacs as compared to Rs. 22.7 lacs if you had started investing earlier.

The above table is an example only for illustration purposes, purely to explain the effect of compounding on investments over a long term. The growth rate of the investment is assumed at 12%. Please note the growth rate mentioned above is purely for illustration purposes only

So, one should start early and invest regularly. As they say “better late than never”. Once you have set-up your monthly investment plan, you can enjoy your newly acquired “bundle of joy”.