Dont wan't to watch the video, read the text instead.

Every individual, after investing in mutual funds would be inquisitive about the performance of the funds. In order to track the returns, the normal practice is to look at the reports published by the fund house. But the published returns of the fund could be different from the returns earned by the investor. The main reason that could be attributed to this is that the time period considered for fund returns could be different from the investor’s return calculation period.

To avoid this anomaly, an investor would have to calculate his portfolio returns separately. There are different ways of representing mutual fund returns:

1. Simple Absolute Return

Seema is a new investor in mutual funds who has started her investments just six months back. She is inquisitive to know how her fund has performed so far. She checks her statement where she sees that her fund NAV has moved from10/- to 12/- in the first six months. She assumes that her fund has given an annualized return of 40%. Is this the right way of calculating returns?

If we use Simple absolute return method, this is how we could calculate her returns:

| Investment Amount | Value after six months | Simple Absolute Return |

|---|---|---|

| 1,00,000 | 1,20,000 | (1,20,000 – 1,00,000)/1,00,000 = 20% |

Hence, Simple absolute return just tells the investor what the returns are in simple percentage terms the in the given time period. But this method of calculating returns should be used only if the tenure is less than one year. The only exception to this rule is in the case of liquid funds where the returns can be annualized.

2. Compounded Annualized Growth Rate (CAGR)

Seema continued her investment in mutual funds and has now been invested for 3 years. Her husband also wants to start investing in mutual funds and wants to know how much return her mutual funds have given over the last three years. Seema checks her portfolio and sees that her 1,00,000/- invested has become 2,20,000/- in 3 years. She believes that her fund has given 40% annualized return. Is this the right way of calculating annualized returns?

We use the CAGR method to calculate the performance of a fund year on year or in other words the annualized returns.

| Investment Amount | Value after 3 years | CAGR |

|---|---|---|

| 1,00,000 | 2,20,000 | ((2,20,000/1,00,000)^(1/3)) -1 = 30% |

Hence, CAGR tells the investor the annualized returns given by the fund over the specified time period. CAGR is used to calculate the performance of a fund if the investment tenure is more than one year. If the investment has given 10% annualized return over 8 years, it does not mean, that every year the investment has consistently given 10%. There could have been years where the returns would have been more than 10% and other years the returns would have been less than 10%. However, over the eight year time horizon, the investment has given an equivalent of 10% annually.The CAGR is the most commonly accepted method of depicting fund performance.

3. XIRR

Seema has been an avid mutual fund investor after having experienced good returns. She has been using mutual funds as a tool to save for various financial goals. She invests as and when she gets a surplus. She also withdrewsome amount after eight of investment for her daughter’s higher education. Here is how she has invested and redeemed money over years:

| Date | Amount Invested | Amount Redeemed |

|---|---|---|

| 1-Dec-05 | 1,00,000/- | - |

| 3-Jan-07 | 1,20,000/- | - |

| 23-Mar-10 | 1,00,000/- | - |

| 30-Oct-13 | - | 4,00,000/- |

| 31-Dec-14 | 2,50,000/- | |

| 2-Jan-16 | 12,00,000/-* | |

| XIRR | 20% | |

*Current Value

To calculate XIRR , using excel 2 most important elements are date of the transaction and value of the transaction. Hence, XIRR is the method used to calculate the performance of a mutual fund when the cash flows are irregular or over different periods of time. XIRR takes into account a real time investment scenario where an investor has multiple cash flows. XIRR could be used to arrive at the returns given by SIP’s.

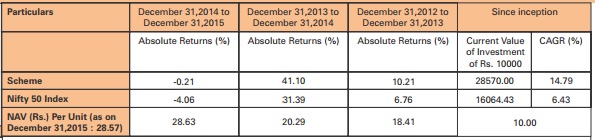

4. Fund return representation as per compliance requirement

It is required for an AMC to publish the following in the factsheet

The last three preceding year returns

The returns have to be compared to a benchmark

Illustration showing how a single investment in the mutual fund would have performed since inception v/s the nifty performance